The Only Guide for Medicare Advantage Agent

The Only Guide for Medicare Advantage Agent

Blog Article

Some Of Medicare Advantage Agent

Table of ContentsHow Medicare Advantage Agent can Save You Time, Stress, and Money.The 3-Minute Rule for Medicare Advantage AgentAn Unbiased View of Medicare Advantage AgentGetting The Medicare Advantage Agent To Work

Health and wellness insurance coverage regularly ranks as one of one of the most important benefits amongst employees and task candidates alike. Providing a team health strategy can aid you preserve a competitive benefit over various other employers especially in a tight task market. When employees are fretted about just how they're going to handle a medical issue or spend for it - they can become stressed and distracted at work.

It likewise supplies them comfort knowing they can pay for treatment if and when they require it. Medicare Advantage Agent. The choice to offer employee health and wellness advantages typically boils down to a matter of cost. Lots of local business proprietors forget that the costs the quantity paid to the insurance provider each month for protection is generally shared by the company and workers

The Single Strategy To Use For Medicare Advantage Agent

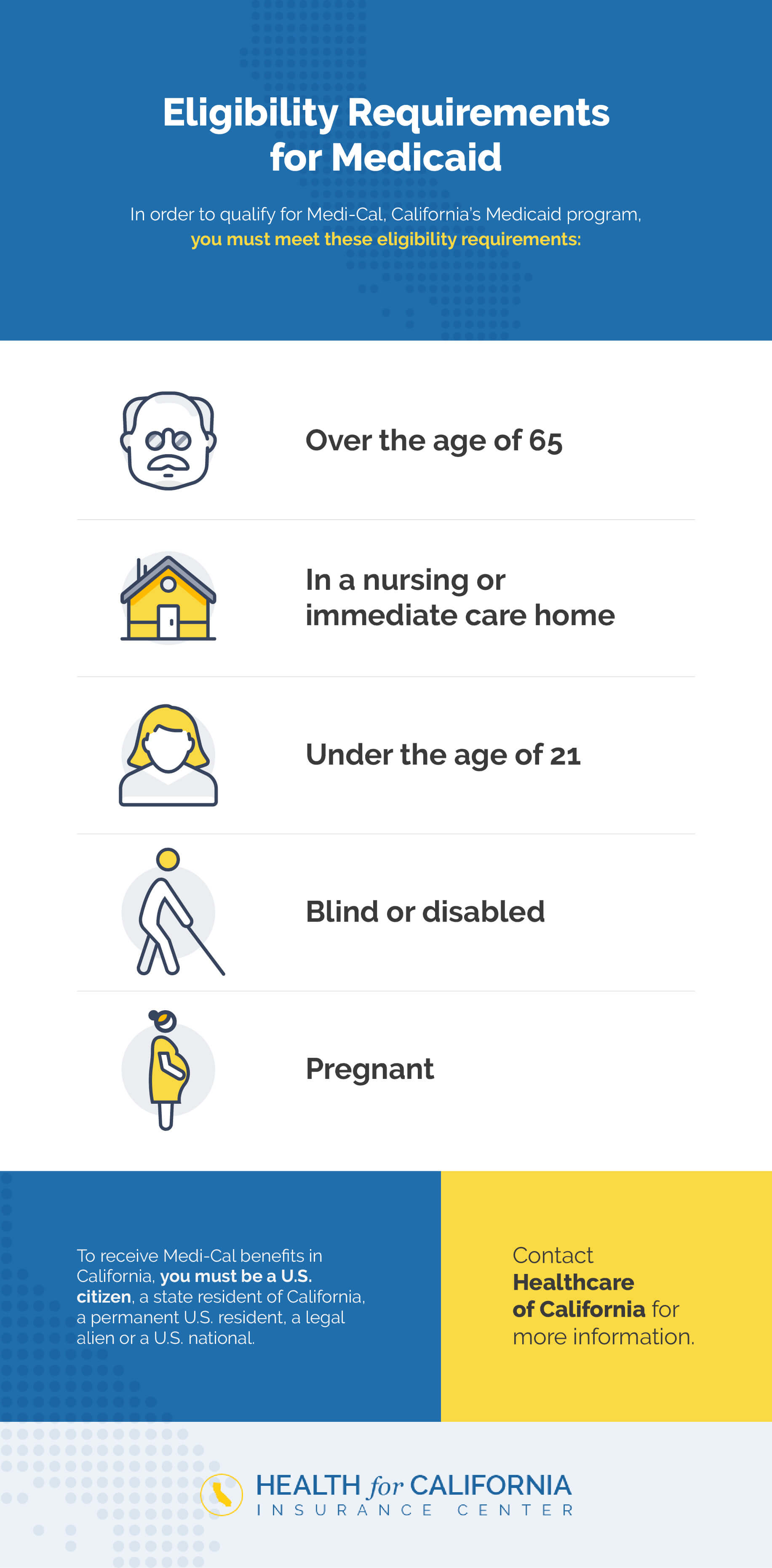

These choices can include medical, oral, vision, and a lot more. Discover if you are eligible for coverage and sign up in a strategy with the Marketplace. See if you are qualified to utilize the Medical insurance Industry. There is no earnings limit. To be qualified to enlist in health and wellness coverage via the Market, you: Under the Affordable Care Act (ACA), you have unique patient defense when you are insured via the Medical insurance Industry: Insurance firms can not decline coverage based upon gender or a pre-existing problem.

No person prepares to obtain really unwell or pain. When it happens to you or your household, it can set you back a lot of cash to get treatment. Medical insurance can shield you from these high costs. If you purchase wellness insurance policy, it can easily cost you less cash than mosting likely to the medical facility without it.

Wellness insurance coverage still sets you back cash and selecting the ideal policy for you can be hard. Medicare Advantage Agent. What if you already have insurance?

Discover about the kinds of advantages to anticipate when you have health insurance policy. Find out extra regarding the cost of wellness insurance coverage including points like co-pays, co-insurance, deductibles, and costs.

Medicare Advantage Agent Things To Know Before You Buy

It will sum up the key attributes of the plan or insurance coverage, such as the covered advantages, cost-sharing stipulations, learn this here now and protection limitations and exceptions. Individuals will obtain the summary when looking for coverage, enlisting in coverage, at each brand-new strategy year, and within 7 organization days of requesting a duplicate from their medical insurance provider or group health insurance plan.

Thanks to the Affordable Treatment Act, customers will likewise have a brand-new source to aid them understand a few of one of the most common however complex lingo utilized in health insurance coverage (Medicare Advantage Agent). Insurance provider and group health insurance plan will be needed to provide upon request an uniform glossary of terms frequently made use of in medical insurance protection such as "deductible" and "co-payment"

Health and wellness insurance coverage in the U.S. can be complex. Lots of people don't have accessibility to reference good insurance coverage they can manage, and countless people do not have any health insurance policy at all. There are lots of broad view adjustments that the federal government needs to make to make sure that medical insurance works much better.

Medicare Advantage Agent Things To Know Before You Get This

"Sometimes insurance coverage companies likewise make changes to advantages in terms that are usually appropriate upon revival of the policy, therefore you intend to ensure that you're assessing those and you comprehend what those adjustments are and exactly how they may affect you," Carter claims. It's likewise worth examining your benefits if your health and wellness has actually altered lately.

"If consumers can merely make the review of their medical insurance plan a traditional technique, it's something that becomes simpler and less complicated to do over time," states Carter. Just how a lot you utilize your health insurance policy depends on what's going on with your health and wellness. A yearly physical with your key care medical professional can maintain you up-to-date with what's going on in your body, and provide you a concept of what sort of wellness treatment you could require in the coming year.

Report this page